By Blessing Enechojo Abu

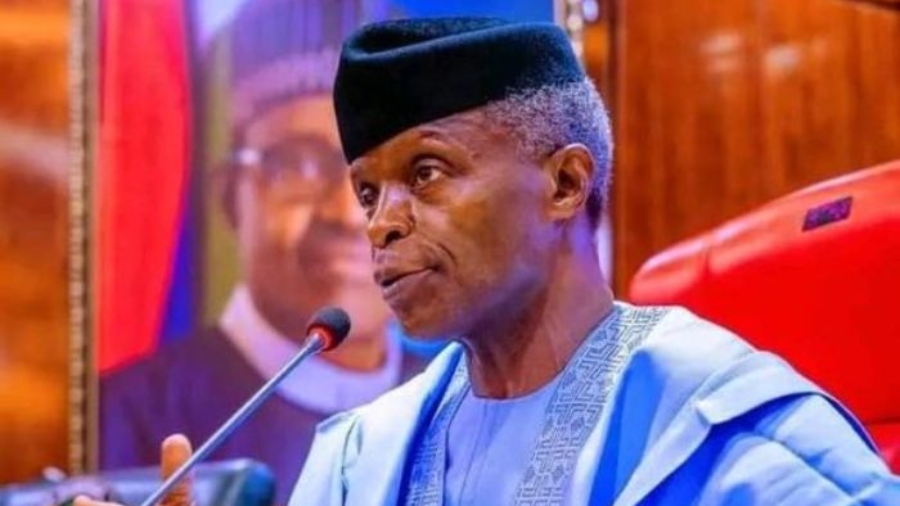

The Vice President, Prof. Yemi Osinbajo has urged major players in FinTech to explore more ways of reducing the current hardships Nigerians are experiencing as a result of the currency swap and the difficulties in getting access to cash.

Since the first deadline set by the Apex Bank, Nigerians have complained about the unavailability or shortage of the new currency notes in circulation.

The new deadline still looks unrealistic as Nigerians in different states continue to besiege the Automated Teller Machines (ATMs) and Point of Sale (PoS) cash operators to access funds without success.

In a virtual interactive session with some FinTech investors, the Vice President encouraged the Central Bank and FinTech investors that have money agents should work together in order to cushion this effect and reach a wider range of places in the country.

In his words: “It seems to me that banks must engage their mobile money operators – FinTechs with mobile money licenses and many of them have micro-finance bank licenses now and already have a network of mobile money agents or human banks or human ATMs (as they are sometimes called) who are responsible to them and they can supervise by themselves. They can do currency swaps and open bank accounts.”

He also addressed the challenges of electronic transaction failures.

“so where in the past you used POS or any of the electronic platforms, you had maybe 20-30 percent failure rate, now because everyone is trying to get on those platforms, obviously, the failure rate is much more and the problems are much more pronounced.” He said.

The players made valuable suggestions and offered their support for the government in addressing the situation at hand. They also suggested a reduction in USSD fees and data used.

Picture Source: Business Day

CBN Governor once again shuns Reps; Reps threaten to issue arrest

Add a Comment